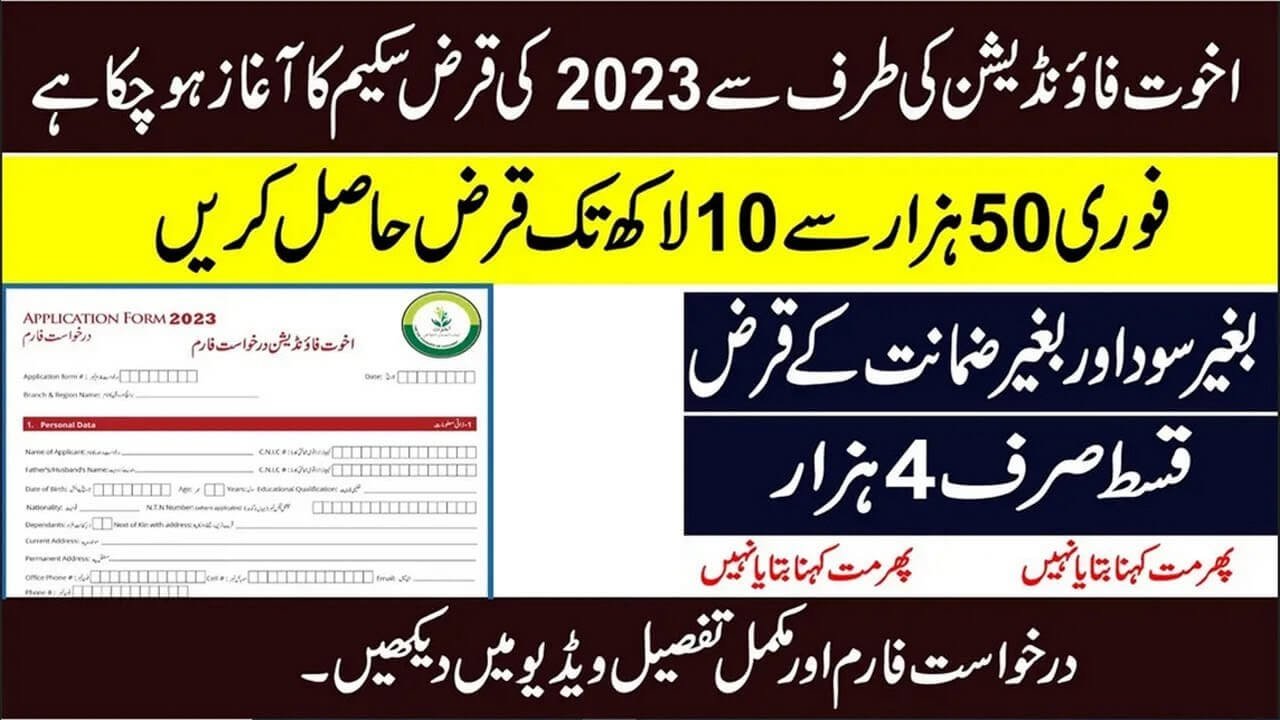

Akhuwat Loan Scheme 2023 Online Apply | Akhuwat Loan Form Download

Akhuwat Loan Scheme 2023 under the ‘Mera Pakistan Mere Ghar’ Initiative: Apply for Non-Profit Loans Online

In the year 2023, the government introduced the ‘Mera Pakistan Mere Ghar’ program, aiming to empower all Pakistanis to build their homes. To achieve this, individuals can access financial support through the Akhuwat Foundation’s Loan Scheme 2023. This article provides comprehensive details about the Akhuwat Foundation’s Loan Scheme.

The Purpose and History of Akhuwat Loans:

Akhuwat Foundation’s overarching vision is to combat poverty in Pakistan. In pursuit of this noble objective, the organization has diligently worked to establish the Akhuwat Loan Scheme 2023, designed to assist low-income individuals. The primary mission is to uplift impoverished communities in our Islamic region, contributing to poverty alleviation on a global scale.

For more information, you can also explore our related article on the ‘Ehsaas Interest Free Loan Program 2023-24’ and Ehsaas Loan Registration.

How To Apply For Akhuwat Loan Scheme 2023 Today

Akhuwat Loan Scheme 2023: Online Application Guide

If you’re planning to build a house on a 5 marla plot and are interested in the Akhuwat Loan Scheme 2023, here’s what you need to know:

- Loan Amount: The loan amount you can receive for building a house on a 5 marla plot will depend on various factors, including your income and creditworthiness. Specific loan amounts can be determined through the application process.

- Monthly Payments: The number of monthly payments you have to make will be determined based on your loan amount, interest rate, and loan tenure. Details can be obtained during the loan application process.

- Loan Tenure: The duration for which you can take out a loan will be specified by the Akhuwat Foundation as part of the application process.

- Loan Eligibility Conditions: To qualify for the Akhuwat Loan Scheme 2023, you will need to meet certain eligibility criteria. These criteria may include income levels, creditworthiness, and other factors. A complete guide on eligibility conditions is available in this article.

To apply for the Akhuwat Loan Scheme 2023, visit the official website at https://8171ehsaasprogram-25000bisp.com/ for online registration in 2023. Download the application form and complete it with all the required details, including your purpose for the loan (e.g., building a home or starting a business) and the necessary documentation.

Once your application is complete, submit it to the AIM office located near your residence. A unit manager will review your application, discuss any additional information required, and ensure that all necessary documents are provided for loan approval.

Share this comprehensive guide on the Akhuwat Loan Scheme 2023 with friends and family who may be interested in building their own homes in 2023. They can benefit from this program.

For information on the Kamyab Overseas Program and how to apply online, please refer to the relevant sources. | Apply Online For Kamyab Overseas Program

Lending Methodology of AIM (Akhuwat Foundation)

AIM’s lending policy primarily revolves around providing interest-free or Qard-e-Hassan loans, typically through group lending. However, the choice of lending methodology may vary based on the specific loan product and the unique project requirements.

- Group Lending:

- AIM predominantly employs a group lending approach, wherein loans are extended to a group of individuals with similar financial needs and objectives.

- Group members collectively guarantee each other’s loans, fostering a sense of community and mutual responsibility.

- This approach promotes social cohesion and ensures repayment accountability among group members.

- Individual Lending:

- In certain cases, AIM may opt for individual lending, especially when the loan product or project demands a more personalized approach.

- Individual lending provides borrowers with loans tailored to their specific financial circumstances and objectives.

- It allows for a more flexible and individualized lending process.

The choice between group lending and individual lending is made based on the nature of the loan, the requirements of the project, and the preferences of the borrowers. AIM’s commitment to interest-free lending remains constant, regardless of the chosen lending methodology.

Group Lending:

Group lending under the Akhuwat Loan Scheme 2023 involves extending Qard-e-Hassan loans to groups of men and women seeking to improve their family income, despite limited resources. Here’s how the group lending methodology works:

- Groups of 3 to 6 members are formed, with each member jointly guaranteeing the loans of their fellow group members.

- This collaborative approach empowers group members to address their social and economic challenges through collective decision-making and mutual support.

- To apply for a loan, an applicant must create a group consisting of 3 to 6 individuals who live in close proximity to each other. It’s important that the group members are not closely related to each other.

Personal Lending:

Akhuwat Loan Scheme 2023 also offers Personal lending, which involves the issuance of Qard-e-Hassan loans to individual borrowers who meet the scheme’s eligibility criteria. Here’s how personal lending works:

- Loans are provided to specific individuals who qualify for the program, making it more accessible for them to fulfill their financial needs through interest-free loans.

- In the case of individual lending, the applicant must provide two guarantors to support their application for an interest-free loan.

For more information on these loan programs and to apply, individuals can refer to relevant online resources, such as the Agahe Pakistan Interest-Free Loan.

Check Online Nadra 2023 | 8171 Ehsaas Program 25000 Bisp Check Online

Application Submission – Akhuwat Loan Scheme 2023 apply online

The online application process for Akhuwat loans commences with the submission of an application. The application fees may vary depending on the specific loan scheme. Subsequently, the division manager will assess the application against the predetermined eligibility criteria, ensuring that these loans are provided under social security. The following steps outline the application procedure:

- The applicant will visit the nearest AIM branch and submit the necessary documents (listed below) as part of the loan application process.

- The unit manager will engage in a discussion with the applicant to determine their eligibility for the scheme.

- The potential candidate will complete a loan application form, which will be submitted and processed by AIM staff at the branch.

- The unit manager will review the provided documents, and the application will proceed once all required documentation is in order.

Furthermore, here are the details regarding the types of collateral that can be considered for loans:

- Personal liability

- Two sureties

- Overdue checks

- Additional security in special cases, as needed.

Social Assessment, Akhuwat Loan Scheme 2023

As part of the Akhuwat Loan Scheme 2023, plays a crucial role in evaluating the eligibility and credibility of loan applicants. This process involves a thorough examination of the applicant’s social background and circumstances to ensure responsible lending. Here’s how social assessment is conducted:

- Information from Existing Borrowers: Insights are gathered from individuals who are already borrowers under the Akhuwat Loan Scheme. These borrowers may provide valuable information about the applicant’s character, repayment history, and overall credibility.

- Assessment from Lifestyle: The lifestyle and living conditions of the applicant are considered. This includes an examination of the applicant’s economic circumstances, standard of living, and financial habits.

- Neighbor Opinions: Neighbors of the applicant are consulted to gather their opinions and observations regarding the applicant’s reputation, behavior, and social standing within the community.

- Personal Interview/Family Interview: A personal interview with the applicant or their family members is conducted. This interview allows for a direct conversation with the applicant to understand their financial needs, intentions for the loan, and ability to repay it responsibly.

By utilizing these methods, Akhuwat Foundation ensures that the loans are provided to individuals who are genuinely in need, have the capability to repay, and maintain a strong standing within their community. This social due diligence process helps maintain the integrity and sustainability of the loan program while promoting responsible lending practices.

Business valuation

Business valuation, in the context of the Akhuwat Loan Scheme 2023, involves a comprehensive assessment of a prospective borrower’s business plan and idea to determine its viability and potential to generate income. Here’s how this assessment is conducted:

- Business Plan Review: The first step is to thoroughly review the business plan presented by the prospective borrower. The business plan outlines the details of the proposed venture, including its objectives, strategies, financial projections, and operational plans.

- Viability Assessment: The business idea is assessed to determine if it is economically viable. This assessment involves analyzing whether the business has the potential to generate income that surpasses the borrower’s household expenses, ensuring that there is sufficient income to repay the loan.

- Business Requirement Evaluation: The specific requirements of the proposed business are evaluated. This assessment helps identify the financial and operational needs of the business and ensures that the loan amount aligns with these requirements. It also assists in refining the applicant’s business idea to optimize its chances of success.

- Applicant’s Family Interview: To ensure that the applicant’s family is aware of the loan and supportive of the business idea, interviews may be conducted with family members. This step helps gauge the level of commitment and cooperation within the household, as the success of the business can significantly impact the entire family.

By conducting a thorough business valuation, the Akhuwat Foundation aims to support viable and sustainable business ventures. This assessment process not only helps in making informed lending decisions but also contributes to the overall success and growth of the businesses financed through the Akhuwat Loan Scheme 2023 program.

Secondary Evaluation and Loan Approval Process:

Following an initial assessment, the loan application is forwarded to the branch’s head for a secondary evaluation. During this phase, both the social and business evaluations are re-assessed. Additionally, a meeting is scheduled with the borrower and their guarantors to further discuss the Akhuwat Loan Scheme 2023 application.

Akhuwat Loans Scheme 2023 Loan Guarantors :

In cases of individual lending, each applicant is required to provide two guarantors who serve as endorsers of the borrower’s credibility and assume responsibility for supervising the borrower. They also provide a guarantee that the Akhuwat Loan Scheme 2023 will be repaid punctually. In group lending scenarios, group members collectively guarantee each other, formally establishing a group as part of the loan application process.

Loan Approval Committee (LAC):

Each branch operates with its own Loan Approval Committee (LAC), with the regional manager as its chairperson. Other committee members include heads of various departments and the head of the branch. The LAC convenes to review all credit cases thoroughly. If the committee approves the loan application, the loan is formalized and becomes ready for disbursement.

The entire process, from application submission to Akhuwat Loan Scheme 2023 approval, typically takes approximately 3-4 weeks to complete.

Request for Funds and Head Office Interaction:

Once loans receive approval from the Loan Approval Committee (LAC), the necessary funds are requested from the head office through the regional manager. The head office manages the transfer of funds to the designated bank account for disbursement. Upon the successful transfer, the area accountant is notified, and the district accountant prepares checks for approved applicants.

Loan Repayment Process:

Loan repayments occur on a monthly basis during a dedicated event, often held in a mosque or church. In the case of individual lending, applicants must be accompanied by at least one guarantor, while in group lending, all group members must be present for disbursement.

Key Points Regarding Loan Repayment Event:

- Presence Requirement: Each borrower must be present during the repayment event; failure to attend may result in the loan not being issued or potential cancellation.

- CNIC Verification: Borrowers should bring their original CNIC (Computerized National Identity Card) for verification.

- Check Distribution: Borrowers receive checks for the authorized loan amount, and the confirmation of checks is obtained from each borrower.

- Regional Manager Oversight: The Regional Manager oversees the disbursement of funds.

Social Leadership and Agenda:

During the disbursement event, social leadership initiatives are also emphasized. These initiatives aim to enhance borrowers’ capacities to work more effectively and ethically, in line with Islamic or ethical principles. Social agenda items may include:

- Promotion of girls’ education

- Service to the broader community

- Environmental conservation and improvement

- Encouragement of tree planting

- Adherence to traffic rules and local laws

- Upholding the highest ethical values in business practices

Recovery and Follow-Up Akhuwat Loans Scheme:

Following loan issuance Akhuwat Loan Scheme 2023, the unit manager conducts regular visits to the borrower’s residence and workplace to monitor their progress. Loan repayments are due by the 7th day of each month, and if not received by the 10th, the unit manager contacts the borrower to provide reminders. If the payment remains outstanding, guarantors are contacted and urged to fulfill their responsibility for repayment.

Akhuwat Loan Scheme 2023 Eligibility Criteria- Akhuwat loan application form online 2023

Mandatory Eligibility Criteria for Akhuwat Loans Scheme 2023 for Eligible Males:

- Original CNIC: The applicant must possess a valid original Computerized National Identity Card (CNIC).

- Business Ownership:For Akhuwat Loans Scheme 2023 Applicants must be business owners or involved in economic activities.

- Age Range: The applicant’s age should be between 18 and 62 years.

- Economic Activity: The applicant must be economically active, engaged in a business or income-generating activity.

- Criminal Record: Applicants should not have a criminal record or be convicted of any criminal activity.

- Good Social Standing: Candidates are expected to have a good social status and character.

- Guarantors: The applicant is required to provide at least 2 guarantors, even if they belong to the same family.

- Proximity to Branch Office: The applicant’s place of residence should be within a certain radius (typically 2 or 2.5 km) of the branch office.

Please note that Akhuwat Loans Scheme 2023 eligibility criteria for loans may change over time, and the organization reserves the right to modify these criteria as needed.

Regarding the sharing of personal information, it is essential to exercise caution and not share sensitive details such as ID card numbers and phone numbers with unknown or unverified sources. Privacy and security are of utmost importance, and individuals should prioritize safeguarding their personal information.

The information provided on this website is sourced from reputable resources, and efforts are made to ensure accuracy and quality. Users are encouraged to rely on trusted sources for personal and sensitive information and exercise discretion in their online interactions.